Payment Settings enables you to configure global default payments settings within CMD. These settings allow you to really personalize and make the payment screen work for you and your workflow. There are two sections of settings you can configure customer payment settings and user payment settings.

This Account Setting allows you to set a hard close date within a customer account. A hard close is a strict deadline after which all transactions during a specified period have been entered and reconciled. After a hard close, no transactions received during that period can be changed, and no new transactions that were received during that period can be entered.

Who Can Use This Feature?

Auth Reps are able to remove the Hard Close date or set it to a past/future date.

Admins are able to can update the Hard Close date to a new future date.

Users with the Hard Close permission set to Update can update the Hard Close date to a new future date.

Users with the Hard Close permission set to Administer can remove the Hard Close date, or set it to a past date, allowing users to change transactions that were previously closed.

Select Payment > Settings.

Click the Edit button.

Hard Close (or, close the books on) financial transactions?

If set to Yes, this will allow users to select a hard close date for financial transactions in order to "close the books" on the specified date.

To add/update the Hard Close Date, click the

icon and use the calendar to select a date.

icon and use the calendar to select a date.

Exclude charges and debits from Hard Close? When the Hard Close date is set, charges and debits will still be available to enter or edit for the closed period.

If set to Yes, this will allow users to enter or edit (override) charges and debits for the Hard Close period.

Click Save.

Financial details for charges, payments, and credits may not be entered, modified, or deleted if they took place on or before the Close Out Date.

Financial details for charges, payments, and credits may not be entered, modified, or deleted if they took place on or before the Close Out Date.

For More information visit our Hard Month Close FAQs.

Payment Settings enables you to configure global default payments settings within CMD. These settings allow you to really personalize and make the payment screen work for you and your workflow. There are two sections of settings you can configure customer payment settings and user payment settings. Customer Payment Settings are the settings that will be the same for all users within the practice. User payment settings are unique to each individual user and do not carry over to other users.

Who Can Use This Feature?

Users with access and modify permission for Practice can edit Payment Settings for Customer.

Select Payment > Settings.

Click the Edit button.

Click the Copy Settings link to copy the current settings to another customer associated with your account.

Allow users to post insurance payments without the check # populated?

If set to No, users will not have the ability to post payments without entering the check #.

Automatically create an information line when entering deductible amount with insurance payment?

If set to Yes, an information line will be added to the payment when adding a deductible amount to the insurance payment.

When applying an account credit, default the received date to the date the original payment was received? By default, the received date will be set to the date the credit is applied. (This is typically for reporting purposes).

If set to Yes, the received date for an account credit will default to the date the original payment was received.

Automatically calculate insurance adjustments for non-primary payments based on the allowed amount and the charge balance? (This is typically not the correct adjustment amount for secondary payers).

If set to Yes, the insurance adjustments will be automatically calculated based on the difference between the allowed amount and the change balance.

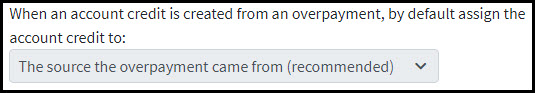

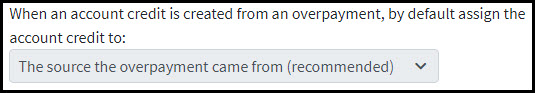

When an account credit is created from an overpayment, by default assign the account credit to:

Use the drop-down menu, to default where an account credit should be assigned if the account credit was created from an over payment.

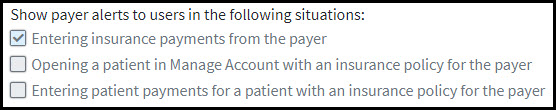

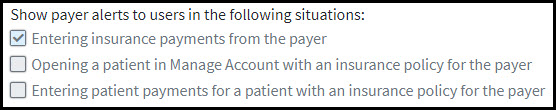

Show payer alerts to users in the following situations:

Place a check in the box(es) to determine when payer alerts should appear to users when posting payments.

Automatically copy the received or appointment date to the copay date of service?

If set to Yes, the copay date of service field will automatically default to the received/appointment date.

Automatically apply unapplied copayment when an ERA is posted?

If set to Yes, unapplied copays will automatically apply to claims with the same Date Of Service (DOS) while posting ERAs.

- Treat capitation adjustments as payments when an ERA is posted?

- If set to Yes, capitation adjustments will automatically be processed as a payment when the amount of the adjustment code (CO-24) exactly matches the allowed amount sent by the payer within the ERAs.

- Allow partial denials when a manual EOB is posted?

- If set to Yes, charges will only be set to "denied" when a remittance code is present with a denied action.

- Automatically copy the last four digits of the credit card to the check # field, if it's empty, when a payment is posted through merchant services?

- If set to Yes, the last four digits of the credit card used will be populated to the check # field if this field is blank.

This option will only be available to customers that have IPP or the Payment Portal enabled through EdgeExpress.

This option will only be available to customers that have IPP or the Payment Portal enabled through EdgeExpress.

- If set to Yes, the last four digits of the credit card used will be populated to the check # field if this field is blank.

Click Save.

Who Can Use This Feature?

Users with access permission for Payments can edit Payment Settings for their User.

Select Payment > Settings.

Click the Edit button.

Click the Copy Settings link to copy the current settings to another customer associated with your account.

Show a warning when posting a new insurance check that is a duplicate of an already entered check based on the payer, check date and check #?

If set to Yes, a warning will appear if you are posting a duplicate insurance check based on the payer, check date and check #.

Print the provider's Tax ID # on patient payment receipts?

If set to Yes, the providers Tax ID # will print on your payment receipts.

Keep the received/check date the same between insurance payments?

If set to Yes, the received and check date will stay the same between insurance payments. This may be used to default a specific date when posting multiple insurance payments from the same date.

Keep the received/check date the same between patient payments?

If set to Yes, the received and check date will stay the same between patient payments. This may be used to default a specific date when posting multiple patient payments from the same date.

Choose a Merchant Account from the drop-down menu

Select whether you want to receive a warning when no card number is entered.

When posting patient payments, default the payment type field to:

No default selection is selected, no payment type selection will populate when posting a patient payment.

Copay is selected, the "copay" payment type will populate when posting a patient payment.

Payment is selected, the "payment" payment type will populate when posting a patient payment.

Add patient to the recently opened list when adding claims to insurance checks?

If set to Yes, the patients “recently opened list” will be updated when adding a new claim to an insurance payment.

Change the payment source to Check on new payments when a check number is entered?

If set to Yes, the payment source will default to “Check” whenever text is entered into the Check # field.

- Automatically post Interest amounts as payments, which will reduce the claim balance owed to subsequent payers and to the patient?

If set to Yes, Any interest amounts linked to claims will be applied to the claim as a payment (must be equal to or less than the balance itself).

Show a confirmation before sending a receipt via email or SMS Text?

If set to Yes, a confirmation pop-up will be shown before a recept is sent via SMS or email.

- Click Save.

icon and use the calendar to select a date.

icon and use the calendar to select a date.